Course Details

Your Growth, Our Mission

Course Description

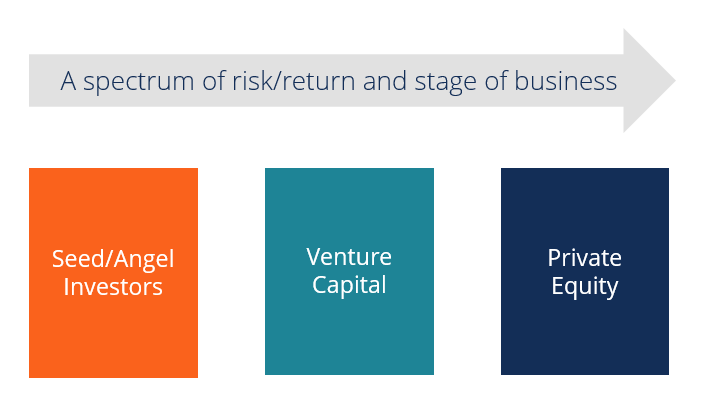

This BTS training seminar focuses on understanding the comprehensive range of alternatives for both debt and equity offered by capital providers worldwide. The program reviews the composition of assets [funds] managed by venture capital [VC] firms, individual and pooled angel investors, hedge funds, and private equity firms. It will examine case examples for each of the four providers relative to internal investment policies, financial positioning, expected time horizons, risk assessment and management, as well as the types of ventures [start-up and emerging growth], larger companies, and selection criteria for product-service projects they invest in. This seminar will also review several global networks for proactive deal-flow and screening-evaluation process flow and referrals, including a wide range of firms, funds, and individual investors from Silicon Valley to SE-Asia, Europe, and online crowd-funding consortia.

The Training Course Will Highlight ?

This BTS training seminar will highlight:

- The roles these four entities play in the global economy and investment infrastructure

- All types of Venture Capital [VC] firms and their typical investment target-profiles

- All types of angel investors and networks, and their typical investment target-profiles

- All types of hedge funds and their typical investment positions / target profiles

- All types of private equity firms and their typical investment positions / target profiles

- The role these four capital providers play in global enterprise development and growth

- The investment criteria, risk positions, and time-horizons required to approach such firms / funds

- Strategies for engaging such firms / funds and securing various types of capital provisions

Training Objective

This BTS training seminar will highlight:

- The roles these four entities play in the global economy and investment infrastructure

- All types of Venture Capital [VC] firms and their typical investment target-profiles

- All types of angel investors and networks, and their typical investment target-profiles

- All types of hedge funds and their typical investment positions / target profiles

- All types of private equity firms and their typical investment positions / target profiles

- The role these four capital providers play in global enterprise development and growth

- The investment criteria, risk positions, and time-horizons required to approach such firms / funds

- Strategies for engaging such firms / funds and securing various types of capital provisions

Target Audience

This BTS training course is suitable to a wide range of professionals but will greatly benefit:

- Anyone looking to expand potential new sources of funds opportunities well beyond traditional commercial banks and investment banks

- Anyone looking to improve financial alternatives for partnering with various capital providers on a wide range of business opportunities and projects

- Anyone looking to identify new sources of funds to support product-service and marketing expansion opportunities

- Board Members looking to enhance the range of capital provider alternatives to support long-term strategic initiatives and industry-market positioning

- Business Development Directors looking to proactively open up new dialogues with a broad range of potential capital providers, each with differing motives and selection criteria

Training Methods

Daily Agenda

DAY 1

Examining the Global Continuum of Capital Providers

- Commercial Banking

- Investment Banking

- Debt Instruments

- Equity Investment Products

- Basics on Risk Assessment, Exposure, and Management

- Federal, State, and Local Government Funds, Grants, and Partnership Allocations

- Define: Seed, Angel, VC, PE, Hedge Stages of Investment Profiles and Expected ROI

DAY 2

Individual Accredited Investors [Angels] and Angel Networks-Associations

- Qualified High-Net-Worth Criteria for Individual Risk Exposure

- Very Early-Stage “Ground Floor” Investment Opportunities and ROI Expectations

- Dealing with Individual Angel Investors and Angel-Investor Funds

- Convertible Notes – Cumulative Interest and Conversion Pricing-Features

- Series A Preferred Stock [Cumulative and Convertible Features]

- Voting Common Stock for Angel Investors

- Key Components of Angel Investor Term Sheets: Project Timing and Risk Profile

- C-Corporation, Limited Partnerships, S-Corporations, Limited Liability Companies

DAY 3

Venture Capital [VC] Firms

- The Risk Profile and Investment Expectations of VCs

- VC Portfolio Approaches to Investments and Selection Criteria

- Venture Stage/Life-Cycle and VC Investment Uses of Funds

- Small “Frontier” VC Entities

- Midsize “Working Capital” VC Firms

- Large “Capital Acquisition” VC Firms

- The VC’s Focus on “Scalability” of the Business Model

- VCs Managing Other VC Funds in Massive Portfolios

DAY 4

Private Equity [PE] Firms

- History and Typical Life-Cycles of PE

- Securities That Comprise “Private” Equity: Time Horizons and Relative Betas

- “Private” Equity vs. “Public” Equity … Valuations, Risk Profiles, Investment Expectations

- Liquidity vs. Illiquidity Concerns for Private Equity Management

- Market Efficiency and the Value of Information

- Active Company Involvement vs. Passive / Non-Involvement and “Value” Investing

- Mergers and Acquisitions [M+A] and PE Opportunities

DAY 5

Hedge Funds

- Nontraditional Investment Profiles and ROI Expectations of Hedge Funds

- Basics on: Arbitrage, Short Positions, Derivatives, Bonds, Index Funds, and ETFs

- Structures of Hedge Funds

- Strategies of Hedge Funds

- Assessment-Performance and Mark-to-Market for Hedge Funds

- Institutional vs. Individual Capital for Hedge Funds

Accreditation

BTS attendance certificate will be issued to all attendees completing minimum of 80% of the total course duration.

Quick Enquiry

Request Info

Related Courses

Your Growth, Our Mission